Notes to the Financial Statements

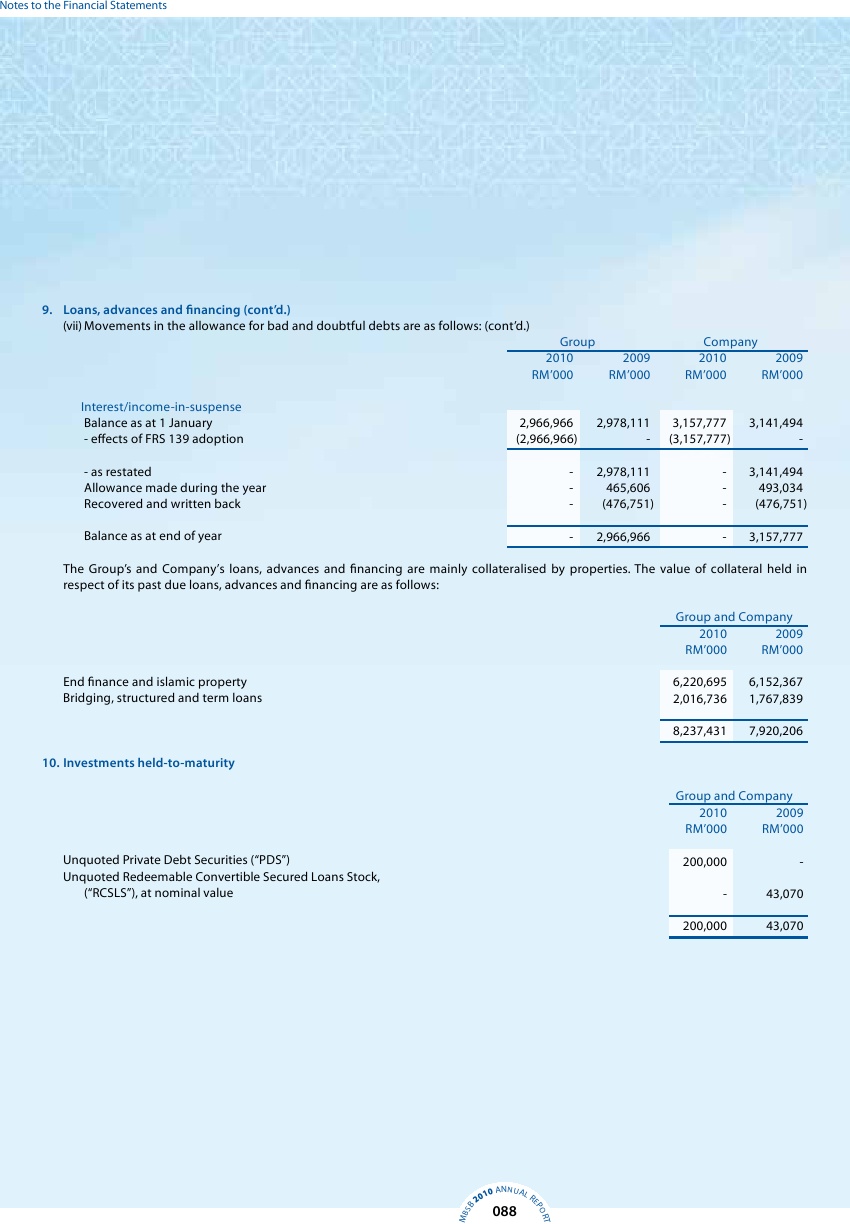

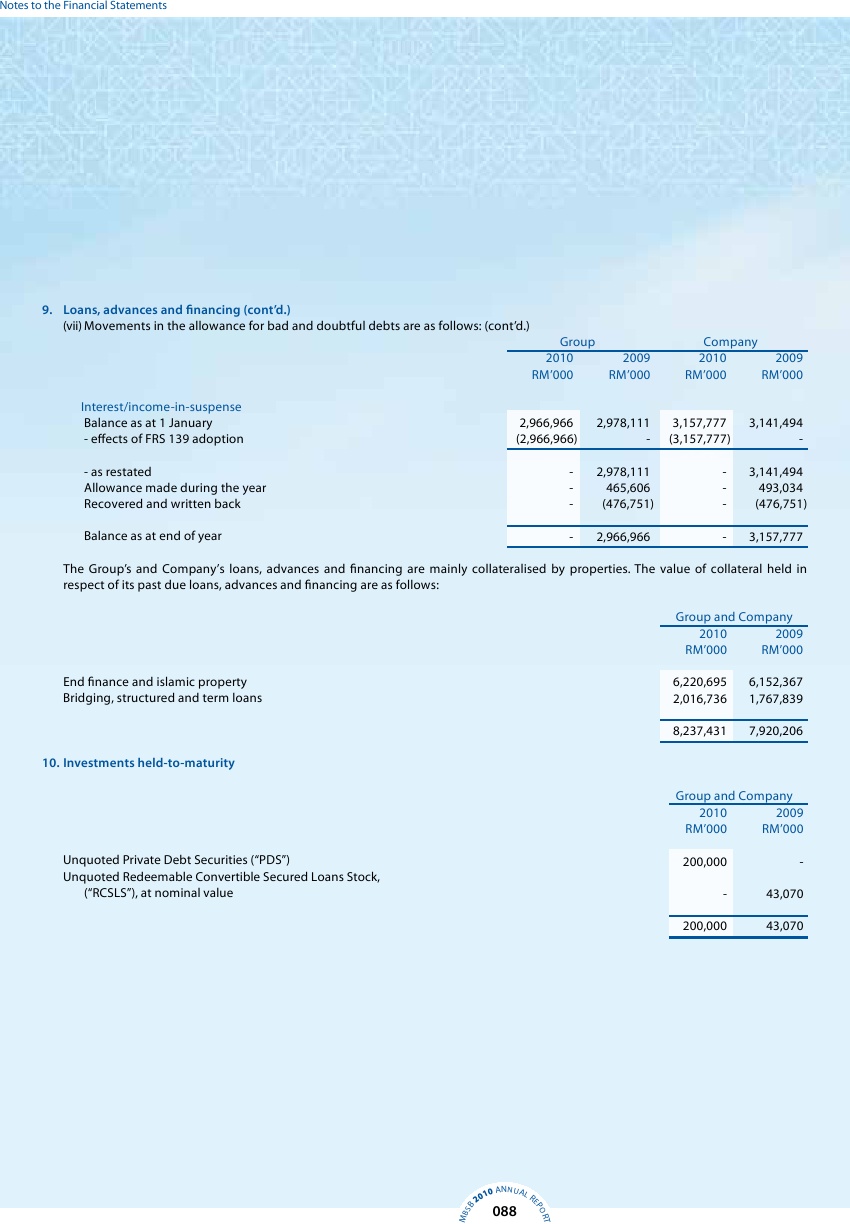

9. Loans, advances and financing (cont'd.)

(vii) Movements in the allowance for bad and doubtful debts are as follows: (cont'd.)

Group

Company

2010

2009

2010

2009

RM'000

RM'000

RM'000

RM'000

Interest/income-in-suspense

Balance as at 1 January

2,966,966

2,978,111

3,157,777

3,141,494

- effects of FRS 139 adoption

(2,966,966)

-

(3,157,777)

-

- as restated

-

-

2,978,111

3,141,494

Allowance made during the year

-

465,606

-

493,034

Recovered and written back

-

-

(476,751)

(476,751)

Balance as at end of year

-

2,966,966

-

3,157,777

The Group's and Company's loans, advances and financing are mainly collateralised by properties. The value of collateral held in

respect of its past due loans, advances and financing are as follows:

Group and Company

2010

2009

RM'000

RM'000

End finance and islamic property

6,220,695

6,152,367

Bridging, structured and term loans

2,016,736

1,767,839

8,237,431

7,920,206

10. Investments held-to-maturity

Group and Company

2010

2009

RM'000

RM'000

Unquoted Private Debt Securities ("PDS")

200,000

-

Unquoted Redeemable Convertible Secured Loans Stock,

Unquoted Redeemable Convertible Secured Loans Stock,

("RCSLS"), at nominal value

-

43,070

200,000

43,070

NNUAL

10 A

20

RE

088