Notes to the Financial Statements

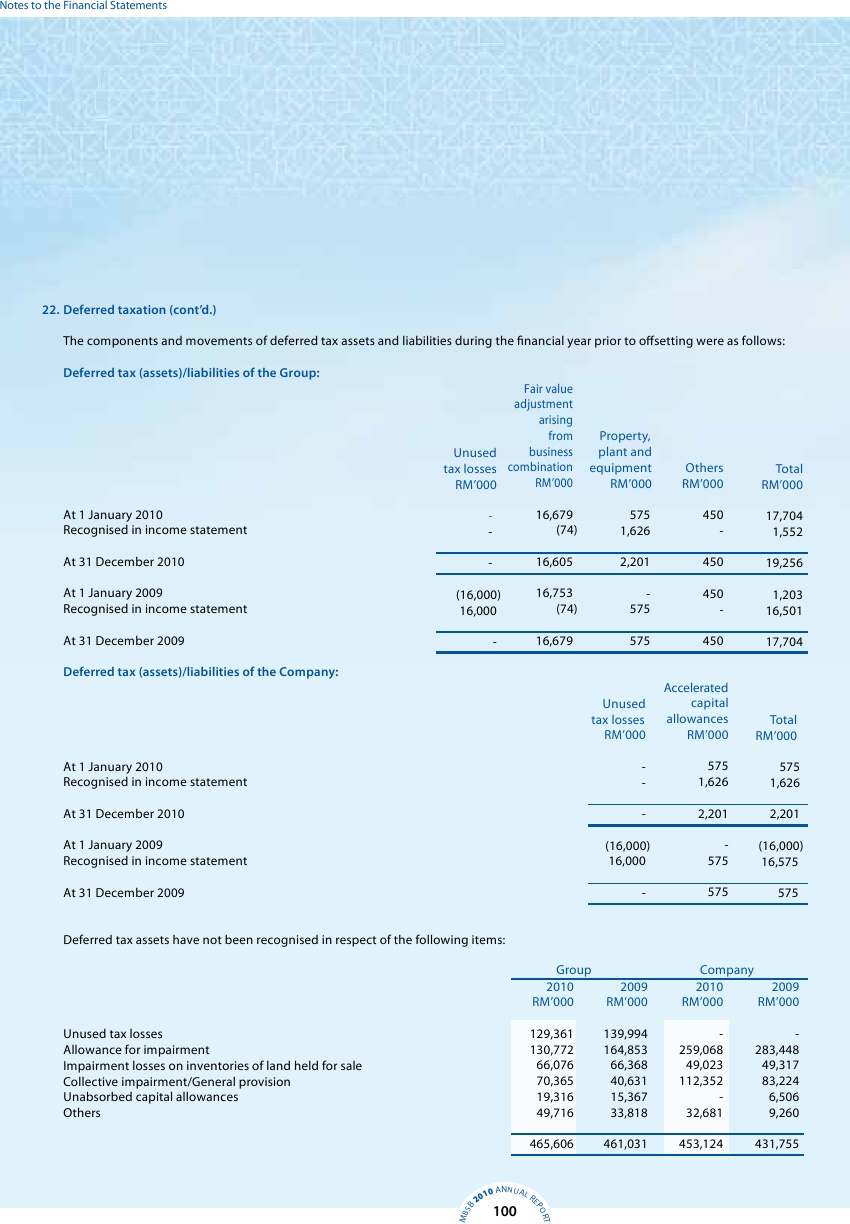

22. Deferred taxation (cont'd.)

The components and movements of deferred tax assets and liabilities during the financial year prior to offsetting were as follows:

Deferred tax (assets)/liabilities of the Group:

Fair value

adjustment

arising

from

Property,

business

plant and

Unused

tax losses combination equipment

Others

Total

RM'000

RM'000

RM'000

RM'000

RM'000

At 1 January 2010

16,679

450

575

17,704

-

Recognised in income statement

(74)

-

1,626

1,552

-

At 31 December 2010

16,605

450

2,201

19,256

-

At 1 January 2009

16,753

-

450

1,203

(16,000)

Recognised in income statement

(74)

575

-

16,501

16,000

At 31 December 2009

16,679

575

450

17,704

-

Deferred tax (assets)/liabilities of the Company:

Accelerated

capital

Unused

allowances

tax losses

Total

RM'000

RM'000

RM'000

575

At 1 January 2010

-

575

1,626

Recognised in income statement

-

1,626

2,201

At 31 December 2010

-

2,201

-

At 1 January 2009

(16,000)

(16,000)

575

Recognised in income statement

16,000

16,575

575

At 31 December 2009

-

575

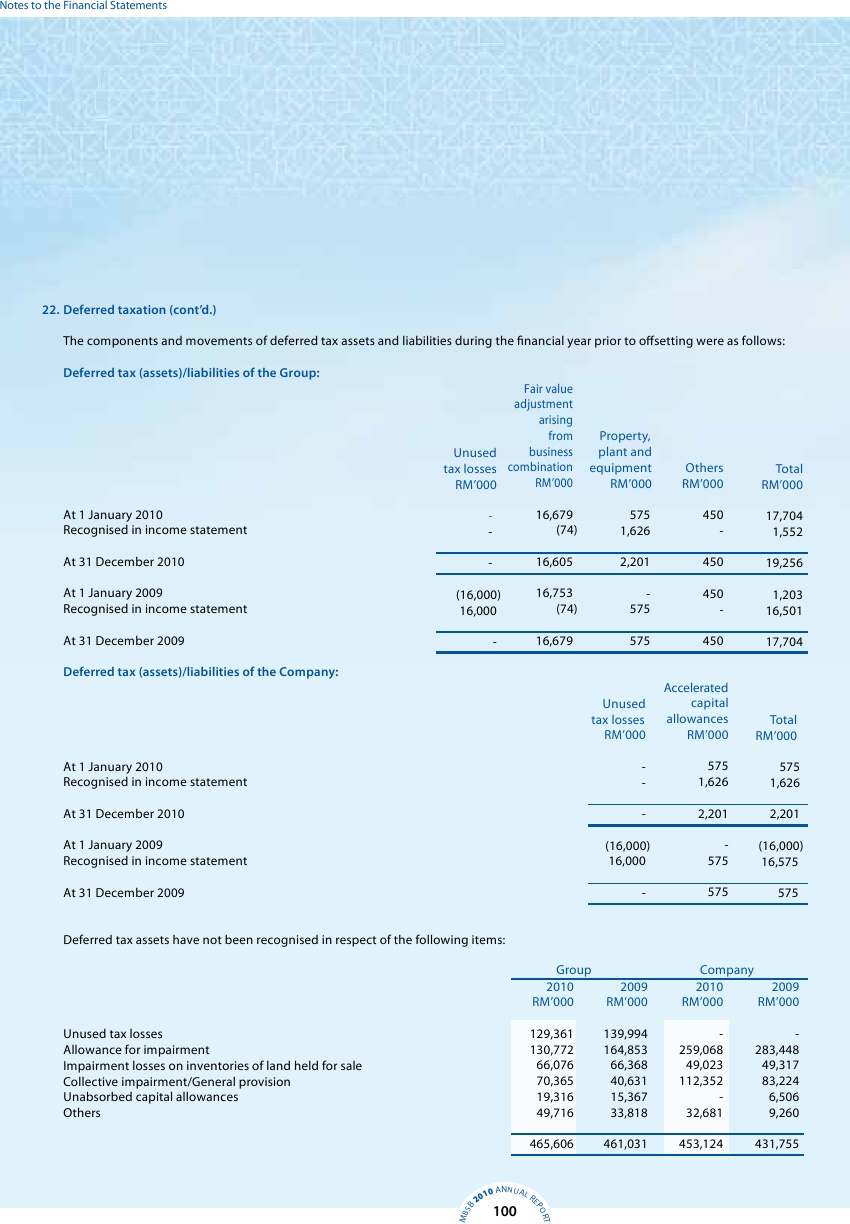

Deferred tax assets have not been recognised in respect of the following items:

Group

Company

2009

2009

2010

2010

RM'000

RM'000

RM'000

RM'000

-

139,994

-

129,361

Unused tax losses

283,448

164,853

259,068

130,772

Allowance for impairment

49,317

66,368

49,023

66,076

Impairment losses on inventories of land held for sale

83,224

40,631

112,352

70,365

Collective impairment/General provision

6,506

15,367

-

19,316

Unabsorbed capital allowances

9,260

33,818

32,681

49,716

Others

431,755

461,031

453,124

465,606

NNUAL

10 A

20

RE

100