Notes to the Financial Statements

44. The operations of Islamic business (cont'd.)

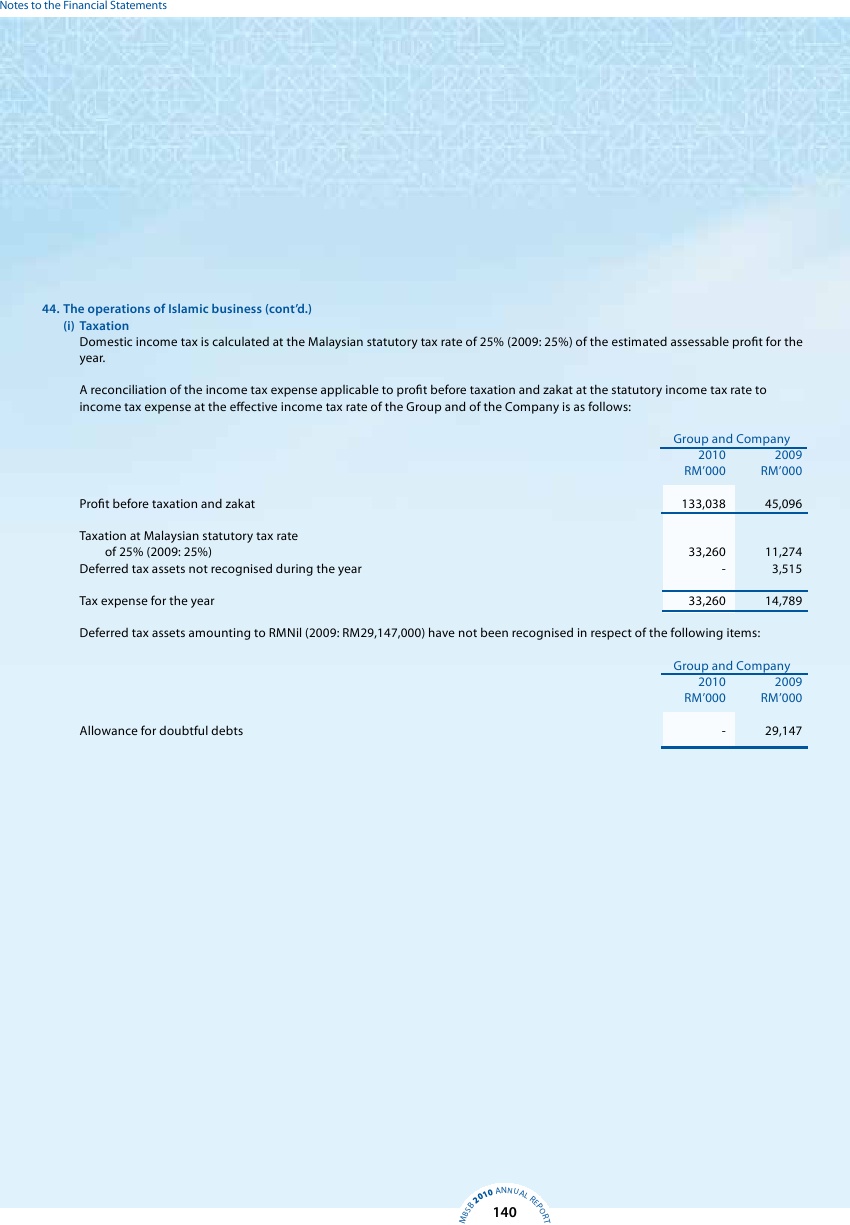

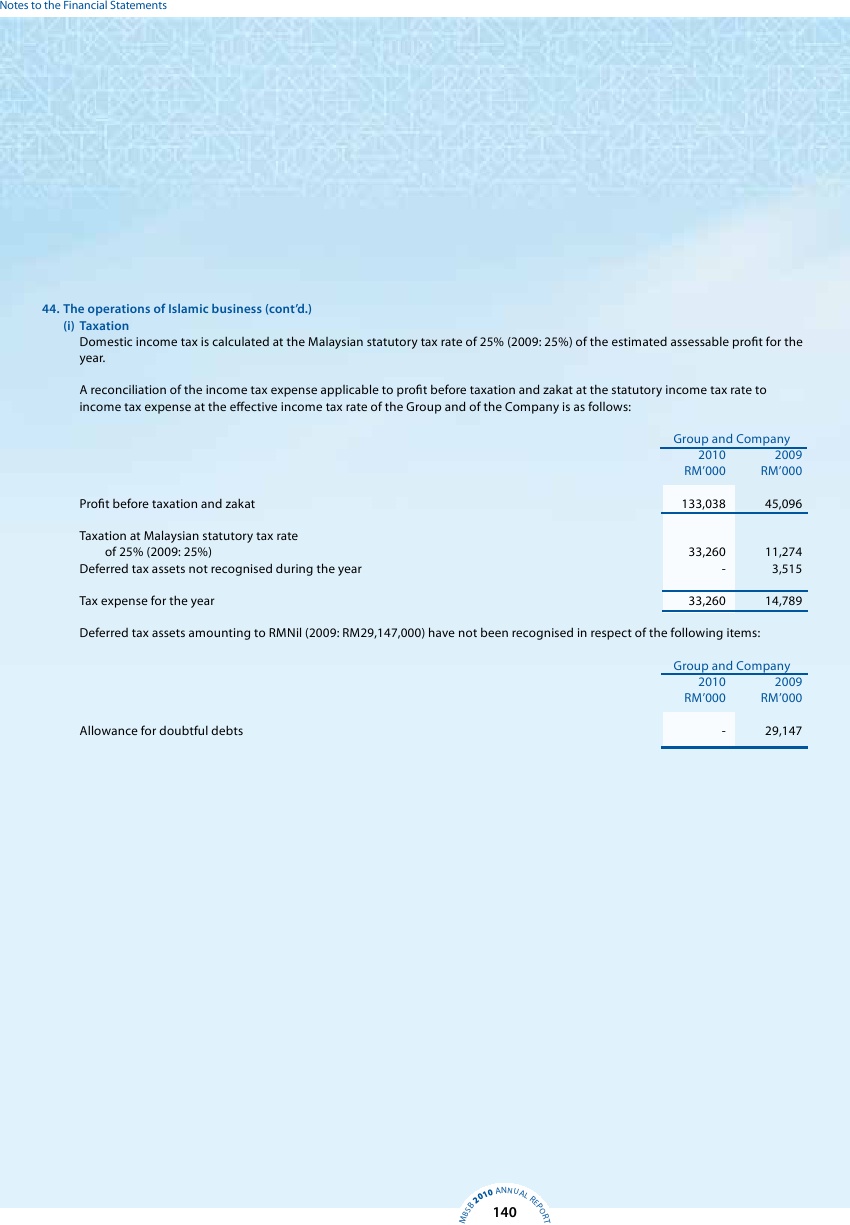

(i) Taxation

Domestic income tax is calculated at the Malaysian statutory tax rate of 25% (2009: 25%) of the estimated assessable profit for the

year.

A reconciliation of the income tax expense applicable to profit before taxation and zakat at the statutory income tax rate to

income tax expense at the effective income tax rate of the Group and of the Company is as follows:

Group and Company

2010

2009

RM'000

RM'000

Profit before taxation and zakat

133,038

45,096

Taxation at Malaysian statutory tax rate

of 25% (2009: 25%)

33,260

11,274

Deferred tax assets not recognised during the year

-

3,515

Tax expense for the year

33,260

14,789

Deferred tax assets amounting to RMNil (2009: RM29,147,000) have not been recognised in respect of the following items:

Group and Company

2010

2009

RM'000

RM'000

Allowance for doubtful debts

-

29,147

NNUAL

10 A

20

RE

140